A Map for Navigating Financial Storms

Ever found yourself in the middle of a storm you never saw coming?

Picture this: You’re on autopilot. In the midst of your daily routine…

And out of nowhere, a phone call shatters your world, totally upending everything you know as your life.

Your eldest son has just been hit with a life-altering diagnosis: type 1 diabetes.

Shortly after that, more horrible news comes your way. Your wife, your rock, is diagnosed with stage three breast cancer. It’s news that flips your world upside down.

Suddenly, you’re in the eye of an emotional and financial storm you could’ve never anticipated.

This isn’t some hypothetical scenario.

This was my reality.

As a financial planner, I’d often advised others on the importance of preparing for the unexpected. I’d made arrangements for my own family, but I never thought I’d need them.

Until I did.

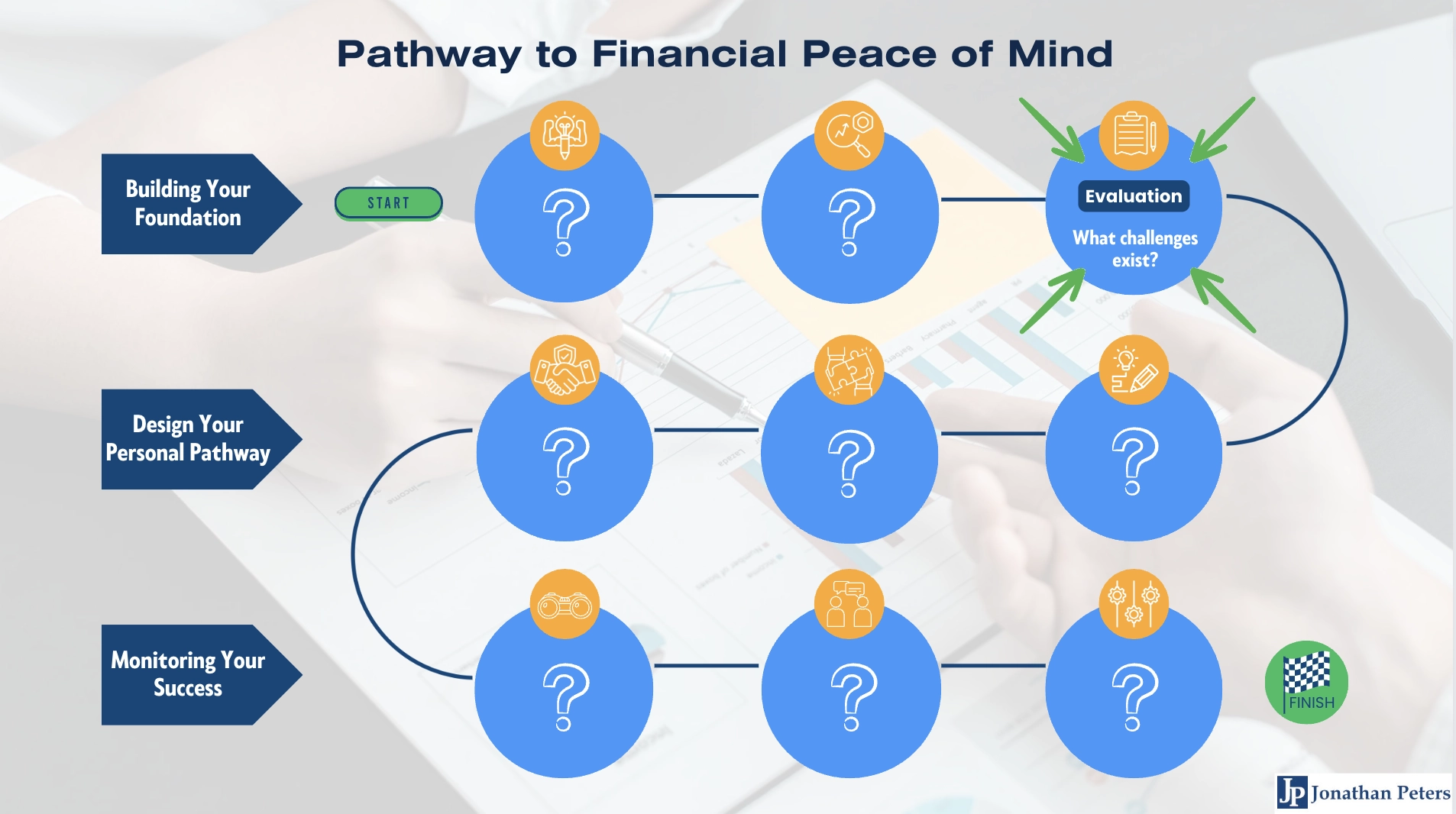

We’re on a journey to financial peace of mind, cutting through the financial fog and taking a financial X-ray to help us uncover what we’ll need along the way.

Now, we’re at the third stage: Evaluation.

Step 3: Evaluation - Embracing The Challenges And Surviving The Storm

This stage is about identifying potential obstacles and crafting strategies to conquer them.

Spotting Potential Obstacles

The first hurdle many of us face is spotting potential obstacles. It’s so easy to get caught up in our goals and totally overlook the hurdles that might stand in our way, you know?

And just like a doctor wouldn’t give treatment without diagnosing the illness first, we can’t create effective financial strategies without identifying potential roadblocks.

Cultivating Problem-Solving Skills

The second hurdle is cultivating the financial problem-solving skills necessary to conquer these obstacles.

This involves learning how to prioritize potential challenges, evaluate different strategies, and make informed decisions.

During the challenging times when my family confronted health crises, I recognized the importance of seeking assistance.

We sought the guidance of a psychologist to help us navigate the emotional toll, while also relying on the support of cherished friends and family members.

Additionally, I understood the significance of seeking professional financial advice to address our needs effectively. I needed someone who could help me navigate the financial labyrinth that comes with unexpected medical issues.

Overcoming Fear of Failure

The third hurdle, and the one that most of us are terrified to admit, is conquering the dreaded fear of failure.

It’s perfectly natural to harbor concerns and anxieties about the potential outcomes when things don’t go as planned.

But listen – fear can be a VERY real stumbling block, preventing us from taking the vital steps towards realizing our financial aspirations.

And that’s definitely not the path we want to go down.

So how can we successfully navigate these challenges, the ones we know about and the ones we haven’t anticipated yet?

Let’s dive in and explore this together!

The answer lies in the three actions of Evaluation.

Action 1: Conduct a Risk Analysis

Let’s start with the first action – conducting a risk analysis. It’s all about identifying potential hurdles and assessing their possible impact on your financial dreams.

By getting a clear picture of the risks you’re up against, you can craft strategies to soften their blow.

The beauty of this approach is that it allows you to see potential pitfalls before they happen, giving you a chance to prepare in advance.

It’s like having a weather forecast for your finances – you know when to expect a storm and can take measures to protect yourself. Plus, it can help you allocate resources more effectively, as you’ll know where they might be needed most.

But, like anything, it has its drawbacks. Risk analysis can sometimes lead to over-caution. There’s a chance of becoming so focused on what could go wrong that you miss out on opportunities that could lead to financial growth.

Action 2: Seek Professional Input

The second action is to seek professional input. Financial advisors can provide valuable insights and advice, helping you evaluate potential obstacles and craft effective strategies.

The advantage here is that you’re tapping into the expertise of someone who knows the financial landscape like the back of their hand. They can provide a fresh perspective and may spot potential issues that you might have overlooked.

However, keep in mind that professional advice can sometimes come with a hefty price tag. Also, it’s crucial to ensure that the advisor you choose is trustworthy and genuinely has your best interests at heart.

Action 3: Anticipate and Plan for Contingencies

The third action is all about anticipation and planning for contingencies. This involves creating a “Plan B” for each potential obstacle, ensuring that you’re prepared for any eventuality.

The main benefit of this approach is that it provides a safety net. If things don’t go according to plan, you’ll have a backup strategy ready to roll out. This can provide peace of mind and reduce stress.

However, the challenge here is that it’s impossible to anticipate every possible outcome. There’s also a risk of spreading yourself too thin by trying to prepare for too many eventualities at once.

So, there you have it.

Three actions to help you survive the financial hurricanes in your life.

Remember, it’s not just about avoiding risks or challenges – it’s about understanding them, preparing for them, and having a plan to tackle them head-on.

Ready to take the next step on your journey to financial peace of mind?

Let’s do this together. Click the image below to get instant access to the Pathway to Financial Peace of Mind!

Your Financial Ally,

Jonathan Peters

Senior Financial Advisor